Table of content

Abstract

The need for capital is the hardest challenge facing startup founders. Capital decides whether businesses grow or die. Without capital, businesses cannot market, cannot promote, and cannot get sales. Capital isn’t a challenge only for early-stage businesses as we have seen very promising businesses getting destroyed by unexpected cash-flow drops. There are many businesses with a very high revenue but end up with a negative cash-flow.

Raising capital is used to accelerate the business, not to build it. Which makes it the best opportunity for both founders and investors. Entrepreneurs establish ownership, control, and lead by building the product first before raising capital, putting them in a more powerful position during the fundraising negotiation. On the other hand, investors are more confident to invest in startups that have launched a product and/or have reached product-market fit, as the investment will, then, help the startup to accelerate the milestones achievements within its roadmap, while being expected to deliver results on-time. Moreover, having a product and historical market data not only puts the startup founder in a more powerful position during the fundraising, it also helps in avoiding a significant dilution when raising capital.

The ideal fundraising round timeframe is between 18 and 24 months. Thus, the fundraising round target should be divided into small actionable steps during the timeframe defined.

During the fundraising timeframe, here are the most important milestones to be achieved:

• Prototypes and beta testing

• Minimal Viable Product (MVP) launch

• Expansion of users and early-adopters

• Revenue

• Product-Market Fit

• Growth

Once the idea is conceptualized, the business plan is created, and the founding team is gathered. Then, startup founders start the first fundraising round to accelerate the achievement of the MVP launch, then get to the second round to achieve the early-adopters expansion, and so on.

Without knowing what investors are expecting, startup founders cannot position themselves as funding recipients. What investors are really expecting is to avoid two main pain points:

• losing investments

• to be made to look foolish.

Below, we listed the items that investors expect from startups:

• solid business plan

• organization

• integrity

• answers to obvious questions

• risk management plan

• market potential

• fundraising strategy

• founders’ skin in the game

• feedback and testimonials

• proof of market demand

• market position (competitive advantage)

Outperforming the competition is one of the most effective strategies to attract capital. It can be measured in different ways: profit margins, sales, community, growth … but one of the most used measurements of outperforming the competition, if not the most used one, is outperforming in growth. It shows the growth of stakeholders believing in the startup’s future potential.

Another pillar of fundraising success is marketing. Startup founders must outmarket all the competing startups and existing companies in order to attract capital. Regular marketing opens the doors for startup founders to attract and convert investors. Thus, startups must design and develop a marketing funnel for their fundraising rounds where investors are guided through the journey to convert.

Web3 Fundraising Models

Web3 and blockchain technology gave birth to new fundraising models that make it easier for startup founders to raise capital. There are mainly two models based on web3 and blockchain technology:

• Crypto Lending

• Tokenization

Let’s dive into the details of each one of these two models.

Crypto Lending

The concept of crypto lending is quite simple. Startup founders can use digital/crypto assets as a collateral to obtain Fiat/Stablecoin loans, while lenders provide the assets required for the loans at agreed interest rates. It can also work the other way around, startup founders use Fiat/Stablecoin as collateral to borrow digital/crypto assets from lenders. This model is rarely used by startup founders as it only fits a few business models.

Decentralized Lending

Decentralized lending protocols offer interest rates that vary based on the supply and demand of an asset, except for MakerDAO where its decentralized governance system determines interest rates. Protocols, like Compound or Aave , allow users to borrow Fiat/Stablecoin or digital assets without going through an intermediary. Instead, a smart contract will be used to ensure the loan is properly executed. This smart contract will automatically perform transactions when predefined conditions are met. This includes interest payments which may be periodic, and unwinding the loan when the funds are repaid.

Centralized Lending

Centralized lending platforms are more like traditional fintechs that work with cryptocurrencies. These platforms tend to offer company-determined interest rates, which may be higher than those offered by decentralized protocols.

Among the most popular centralized lending platforms we can mention Binance, Coinbase and Nexo. These platforms are much more accessible to beginners than decentralized protocols, both from a risk and ease-of-use perspective.

Tokenization

Tokenization opens the doors to value and materialize real world assets in the digital world. By listing an asset and its rights directly on a token, tokenization facilitates management and exchange with a peer, instantly and securely.

A Token is a digital asset issued and exchangeable on a blockchain network. Its price is variable and subject to the law of supply and demand.

A token has several characteristics:

• It can be created by anyone;

• It is customizable by its creator in order to have a decentralized use. It can therefore materialize, for example, a right of use, a right to vote, a copyright, a share of capital,…

• It can be transferred peer-to-peer without duplication (double spending) and without the intervention or agreement of a third party, like a cryptocurrency;

• It is very liquid because it can be sold or bought at any time on an exchange platform.

There are three main token types:

• Payment Tokens

A payment token is a token that is used as a currency of exchange during transactions.

• Utility Tokens

A utility token is a token that plays one or multiple roles within a framework or protocol. For example, it can allow a company to raise funds by pre-selling its products/services in the form of tokens and linking its value to the supply and demand of the products/services. The company usually keeps a percentage of the token supply and is increasing its treasury when the products/services are increasingly used.

• Security Tokens

A security token is a token that represents the rights of ownership of a real world security. It allows a company to increase its capital by freeing itself from the many constraints and regulations imposed by the stock market and more traditional means of financing.

When a company is opening a percentage of its token supply to investors, we say that the company is opening a Token Offering.

Token Offerings take different forms depending on the token type and company’s fundraising round:

• Initial Coin Offering (ICO)

An initial coin offering (ICO) is an Offering form of Utility Tokens. It has the same structure and process during the fundraising rounds (which will be detailed in the next section), except for the Token Listing Round where, in the ICO case, the Utility Token is listed on a centralized exchange (CEX) with a Market Maker.

• Initial DEX Offering (IDO)

An initial DEX offering (IDO) is another Offering form of Utility Tokens. It also has the same structure and process during the fundraising rounds (which will be detailed in the next section), except for the Token Listing Round where, in the IDO case, the Utility Token is listed on a decentralized exchange (DEX) with an Automated Market Maker.

• Security Token Offering (STO)

As its name shows, a security token offering (STO) is an Offering form of Security Tokens. A security token offering can take the same forms during the fundraising rounds as utility tokens, except that it requires from the company more regulatory constraints because of the fact that Security Tokens are representing and linked to real world securities.

There are many solutions providing companies with tokenization solutions. However, in this market, Brickken is considered as a market leader thanks to the features its solution is providing, its backing community scale, its partners, and the multiple innovations it brought to the market.

Brickken offers a free consultation for companies to introduce them to how to raise funds through Tokenization.

Schedule your free consultation with Brickken here and get a more clear idea about your next steps.

Token Fundraising Rounds

Generally, fundraising rounds allow founders to attract and negotiate the capital needed to take their startup to the next stage. A startup founder needs to understand which rounds are specific to his situation, and how to navigate each one properly.

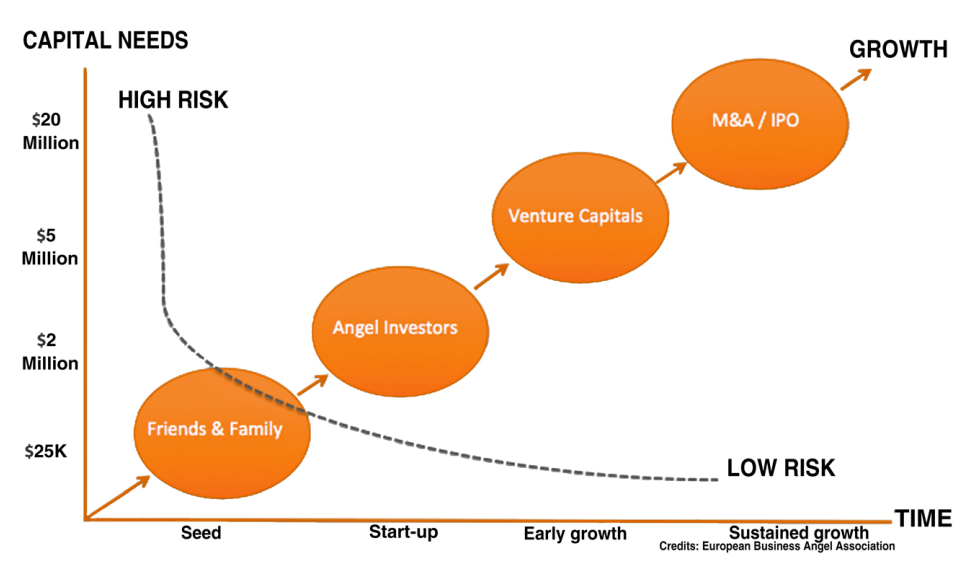

The following figure shows the funding lifecycle of a startup:

The Web2 startups fundraising rounds model is as follows:

• Friends & Family Round

• Pre-Seed Round

• Series A Round

• Series B, C, D Rounds

• Initial Public Offering

Let’s dive now into the new Web3 fundraising rounds model and how it differs from the Web2 model:

Token Pre-Sale Round

The Pre-Sale round of your token usually aims to get startups on solid ground, which makes it suitable mostly for early-stage projects.

Round Objective

The purpose of this round is to provide just enough capital to allow startup founders to work full time on their project. They are expected to show that they have a potentially profitable business on their hands after this round. A subsequent amount of capital will then be made available to take the project to the next phase.

The Pre-Sale round has four main objectives:

- Product identification:

To attract Pre-Sale investment, startup founders will normally have chosen a proven market to explore or a consumer need they want to meet. Strategic round will allow later on startup founders to solidify design elements, pushing them toward a more defined product/service, and perhaps even allow them to create a prototype. - Market orientation:

While startup founders might have an idea about the market they wish to explore, with the Pre-Sale round they will be able to put some resources toward carrying out market research. This will allow them to understand the competition and how to operate more effectively within a specific niche. - Demographic targeting:

Market research will not only allow startup founders to understand the market they are thinking of entering, but it will also help them to identify the target demographics most important to their niche. - Team creation:

While the startup will no doubt add to its personnel during subsequent investment rounds, at the Pre-Sale stage, startup founders should be able to put the core team into place. Startup management is often about having the right expertise working in the right roles, and with this established, the startup will be a more attractive investment opportunity in the future.

Round Investor Personas

Pre-Sale investors tend to be one of the following:

- Web3 Angel investors:

Angel investors are high net-worth individuals who have the finances and desire to provide funding. While there are various levels and definitions of “high networth” individuals, angel investors are segmented as those with a net worth of $1 million in assets or more, or with $200,000 in income for the previous two years. Angel investors are individuals who invest in startup businesses, normally in the early stages. This tends to be on seed rounds of financing and also Series A rounds. Angel investors fill the gap between friends and family, and more formal venture capital funds. Some invest purely for profit. Others look to make an impact with their funds by investing in causes and industries they are really passionate about. Angel investors invest their own money, where the typical amount raised ranges from $150,000 to $2,000,000. Since angel investors are very often individuals who have held executive positions at large corporations, they can often provide fantastic advice and introductions to the entrepreneur, in addition to the funds.

- Crypto Pre-Sale Retail Investors

Retail investors are individuals who focus on investing in token Pre-Sale rounds with a very small investment capital.

- Web3 Crypto Funds

Web3 Venture Capital fundraising requires investing in a good pitch, pitching materials, getting out to make personal connections, and a lot of time in prospecting. For some this is nothing more than a huge and costly distraction. For others it is the ultimate goal. Getting financing from a VC takes time and multiple conversations.

Venture Capital entities pool the funds of angel investors, family offices, sovereign funds, high net-worth individuals, and others. They primarily seek early-stage, high-growth potential investments. While the percentage of funding that VC firms offer may actually be far less than that of individual angel investors, these companies generally seek to make investments in at least the $1 million–plus range.

Finding a good match in a VC firm is critical. Pitching the right matches makes all the difference in terms and the amount of resources expended before securing funding. The largest and best known can be tougher to negotiate with, yet the mere association can help catapult success. Other lesser-known firms may be easier to negotiate with, to acquire better terms.

Token Strategic Round

In terms of scale a normal strategic round can be seen as a larger version of Pre-Sale investment. The purpose of the Strategic round is the same as the Pre-Sale round, to help the startup reach its early goals.

Strategic investment, however, tends to be given in larger amounts by bigger investment groups. It is seen as a high-risk type of investment, and so investors are more cautious than usual when committing themselves to this process, even more so than Pre-Sale investment because the amount of capital at risk is much greater. The second distinction between a Strategic investment round and a Pre-Sale investment round is that a seed investment tends to be greater in scope. Most Pre-Sale investments provide the minimum amount of funding to help a startup develop a Proof-of-Concept (PoC), and to do so over a very short timeframe. The reason for this is that Pre-Sale venture capitalists tend to invest small amounts of money.

Round Objective

A “normal” strategic investment can take a startup close to market, depending on the capital requirements versus the amounts made available by seed investors. That being said, this type of investment is still preliminary, and is designed to get a startup into a position where it is strong, healthy, and ready for more investment; it is simply more robust than the Pre-Sale round. Micro strategic investment also usually requires demonstration of a prototype. With standard strategic investment, the startup may not be required to do this. A startup founder may, however, be asked to have a ready design for his product/service, alongside having undertaken extensive market research to identify the markets and demographics he needs to target. He should also have the essential team in place, including management and possibly even production, marketing, and sales personnel.

Round Investor Personas

Strategic investors tend to be angel investors and larger web3 venture capitalists that normally have under management up to $50 million in capital. They tend to be willing to invest much larger amounts than their micro equivalents. Strategic investors take risks, and many of the investments they make may not work out, but a well managed venture capitalist group or angel investment portfolio, for example, will still see profits due to the startups that do work out generating substantial returns. A strategy used by web3 institutional investors is the model in which investment funds are invested in a number of companies and see which ones pick up traction. Once the startups they are taking on are identified, then they allocate additional capital to invest in follow-on rounds of financing.

Token Public Sale Round(s)

We now come to the Public Sale rounds. A startup might only need one public sale round before its Token Listing, but most startups tend to have multiple Public Sale rounds during their ventures.

Round Objective

The goals for these rounds of investment include:

- Distribution

Establishing marketing strategies and the most effective ways to disseminate information about the product, service, or brand is a key part of Public Sale round(s). By achieving distribution channels for both marketing and product delivery, the startup can lower costs and increase sales.

- New markets

Public Sale round(s) is often sought by startup founders in order to move into new markets through the injection of capital, engaging with different demographics, and furthering brand visibility in the process.

- Next level

At this stage the startup may be established, so Public Sale round(s) can be seen as a way to take the startup to the next phase of the business plan. This could take the form of a new product or service, or it could be improving manufacturing or organizational aspects of the startup to help improve profits.

- Shortfall

The startup may be a promising investment opportunity, but it could be that due to unforeseen events it lacks the cash to become fully self-sufficient. Public Sale round(s) can provide the financial resources to achieve just that.

Round Investor Personas

Public Sale round(s) investors are usually venture capitalists, angel investors, or crypto retail investors. If taking place after a strategic round of investment, potential Public Sale round(s) investors will evaluate how any strategic capital was used and whether this would bode well for their capital. Other profiles of investors that may participate in these types of rounds include family offices, private equity firms, hedge funds, and corporate venture arms.

Token Listing

The Token Listing round is not entered into until a startup has entered into a well-established stage. This is a standard route that many companies take to generate new investment because it can be extremely effective. It normally takes a good amount of time to get to Token Listing, as it requires negotiations with market makers and exchanges.

Round Objective

The Token Listing is the first step to opening your token up to public trades on exchanges, whether it is a centralized exchange or decentralized exchange, including secondary market transactions. Up until this point the startup has relied on a combination of angel investors, venture capital, Pre-Sale money, and Public Round investors. However, the startup is offering a percentage of its token supply to anyone who is willing to legally invest capital. Each time that tokens are released during a Token Listing event, the tokens that current investors hold are diluted slightly, unless there is an anti-dilution agreement in place to protect against loss of token value.

Round Investor Personas

The fact that a Token Listing is a public event means that anyone can invest, as long as they can afford the current token price defined by the market. Some investors will buy directly, while others will have their advisors or fund managers make the buying and selling decisions for them. Often the token holders will be those with an investment history, or those interested in the market and industry you are entering.

Token Economy (Tokenomics)

In general, an asset price results from balancing the supply and demand. When the demand is higher than the supply, the asset price increases and vice versa. Tokens are no exception to the rule. However, it is in the characteristics of supply and demand that they stand out. Indeed, Tokens do not work like any other financial asset. Hence the appearance of this new science, the token economy (tokenomics), aiming to fix on the one hand the quantity and the way in which the offer will be distributed, and on the other hand to imagine the use cases that will generate demand. The main challenge is to avoid the imbalance between supply and demand. This is all the more difficult since it is impossible to anticipate the speed of adoption of a project and its token. This partly explains the high volatility of early-stage tokens.

It is obvious that in general, anything that will tend to increase the token supply will slow down the evolution of the token price. Conversely, the mechanisms that reduce supply are likely to support its price.

There are mainly three factors that affect the amount of a token circulating supply:

Inflation

In most cases, tokens are issued gradually over time until the maximum supply is reached when it is set, there is therefore an inflation of the total supply.

Deflation

Unlike inflation, there are mechanisms to reduce the quantity of tokens, which is then rather favorable in the long term to the increase in price. The main techniques to achieve this are to burn or buy-back tokens. It’s about withdrawing tokens from the circulating supply.

Vesting

Tokens acquired by members of the founding team and advisors, or by private or institutional investors during the early-stage fundraising rounds for example, are often accompanied by a vesting period when the tokens are locked in a smart contract. It is used to prevent the early-adopters of the token who have benefited from very advantageous prices, in return for their risk taking, from being tempted to immediately sell the assets during the Token Listing round and immediately drop the price.

Build your dApp KPIs Dashboard

At Blokrypt Labs, we help web3 leaders realize sustainable growth.

Visualize On-chain and Off-chain Data (token or dApp related).

Get easy-to-read dashboards to monitor your on-chain and off-chain KPIs.

Make data-driven decisions and increase your odds to win in your market.

Ecosystem

Company

Legal

© 2021-2023 Blokrypt SAS | All rights reserved.